by Tiffani Bova

Republished from HuffPost, July 26, 2017

It used to be the day and life of a sales person was defined by how many sales calls they made. Productivity was king. If a great sales person could get a prospect on the phone, it was highly likely that a deal would get done. Having been a sales rep, who ‘dialed for dollars’, a manager who pushed my teams to constantly be working leads to someone who is constantly on the lookout for sales best practices – I was pleasantly surprised to find some compelling new research tackling the topic of what makes a winning sales discovery call.

Gong.io and their data science team began with a simple yet profound hypothesis. If they could record a large enough number of sales calls, they chose over 519,000 to be exact, process those calls using Artificial Intelligence (AI) and their conversation intelligence platform they could identify the structure of an effective sales call and create a list of sharp differences between what works and what doesn’t.

I reached out to Chris Orlob, the guy responsible for publishing this research, to further explore and learn more about the structure of effective sales conversations.

Tell me about the data – how did you go about analyzing this?

We used our own technology and its machine learning capabilities to analyze over 519,000 anonymized B2B sales call recordings. An important distinction is that these calls were all conducted on conference call platforms, such as GoToMeeting. In other words, they weren’t prospecting or cold calls. They were discovery calls (which was identified by mapping calls to their CRM records. I.e. we could reasonably assume it was a discovery call if the call took place during the “Discovery” stage of an opportunity in the CRM) held between an account executive, and a potential buyer.

Here’s how it worked:

– Each call was recorded using Gong, speaker-separated, cleaned, and transcribed from speech-to-text

– Every call was mapped to its matching Salesforce record so we could analyze calls against sales outcomes like close rates, deal velocity and revenue

– Finally, we used Gong’s conversation analytics capabilities to analyze all of the data. Call topics, questions, key moments, and many other seller/buyer behaviors were auto-detected using Gong’s proprietary deep learning algorithms

What were some of the key findings?

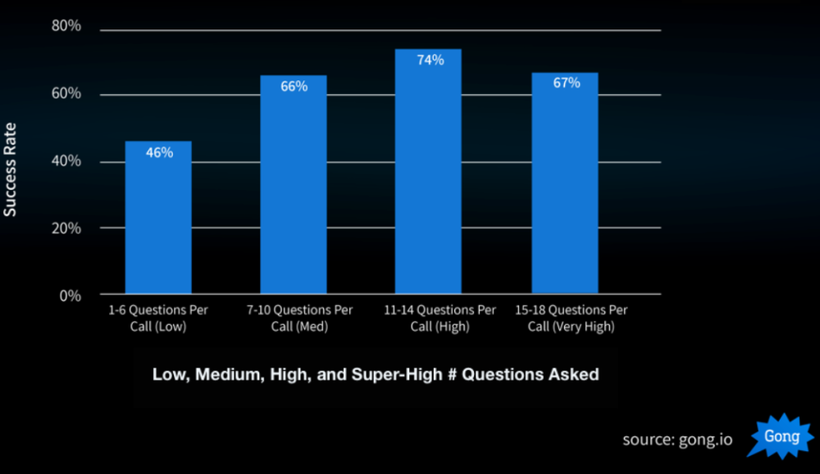

Like many veteran sales pros intuitively know, asking questions, the right questions, plays a big part when it comes to closing deals – but there are some caveats. First, there’s a seemingly strong correlation between the sheer number of questions a salesperson asks[1] , and success.

But it’s not purely a volume game – this is a game of crafting the right set of questions to discover what a customer may need. If you overwhelm the conversation with too many questions, the conversion rate starts to drop off. It turns out, there’s an ideal “range” of how many questions you should aim to ask.

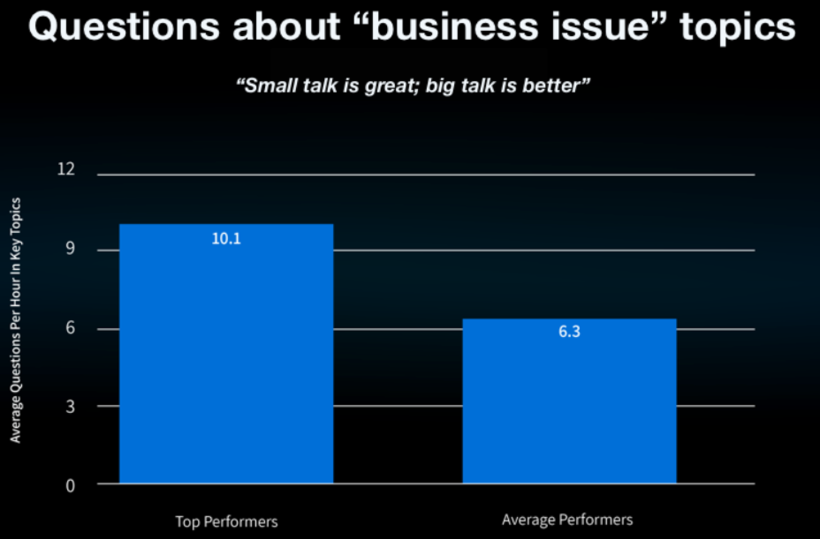

As you can guess, the nature of these questions matters. Asking “how’s it going?” doesn’t count as one of these 11-14 “target questions.” The algorithms we used to analyze all of these sales calls are able to identify topics that are being discussed. We found that top salespeople “aim” most of their questions at the buyer’s key problems, concerns, and goals:

In SPIN Selling, these would be Problem, Implication, and Need-Payoff Questions.

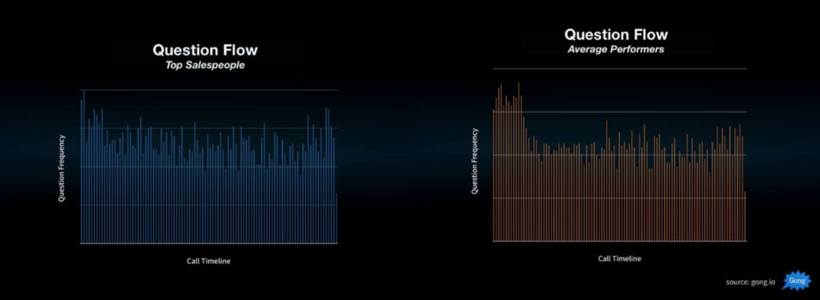

The last point I’ll make about questions: when you ask them seems to have an impact on success. Top salespeople “spread” their questions pretty evenly throughout the entire sales call to facilitate a balanced conversation. “Average” salespeople tend to frontload all of their questions toward the beginning of the call, as if they’re making their way through some sort of “discovery call checklist”.

So we’ve talked about questions. How about the “structure” of successful calls? Did they follow a common pattern?

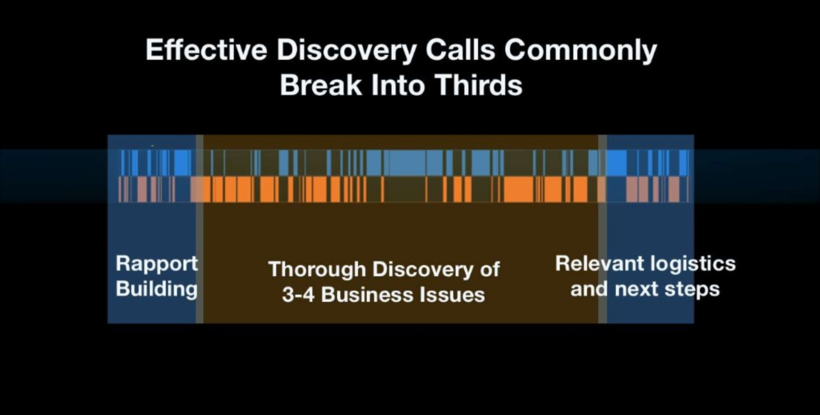

Yes – a successful discovery call is usually split up into three “parts.”

1. Intro and Rapport Building: In almost every case, the best salespeople spend a few minutes building rapport and making small talk before jumping straight into business. It helps “warm up” the buyer for what’s to come

2. Discussion of 3-4 business issues: Next is the “meat and potatoes” of the discovery call. Top salespeople will surface 3-4 key issues, challenges, or goals that are important to the buyer. And they’ll dig deeply into each one.

3. Next steps, and logistics: Finally, like any good “closer,” top salespeople reserve much more time than their peers at the end of each call to discuss the next steps with their buyer. Top reps spend nearly twice as long at the end of their calls “wrapping things up.” As a fun side fact, we found that back-and-forth dialogue (the switching of speaking between rep and prospect) greatly rises during this time, along with the reps’ talking speed

The end-result looks something like this:

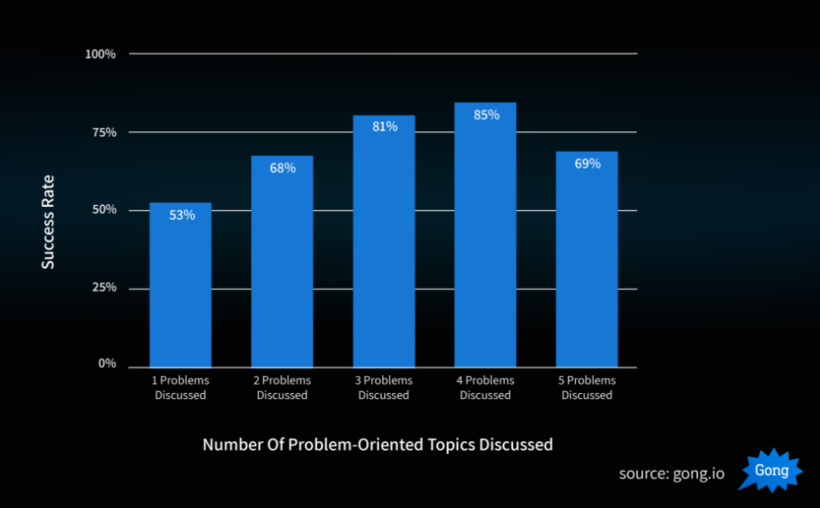

I noticed you said top salespeople surface 3-4 customer problems. Does that number have any significance?

It does. We learned 3-4 is the “sweet spot” in terms of how many problems you want to talk about with your buyer. If you do more than that, your conversion rates drop. You may be spreading the buyer’s focus too thin. And if you do less than that (say, only 1-2), you may fail to dig up enough pain to move your buyer to action:

Does the length of these calls matter? Is there a difference between a 30 minute and a 60 minute call?

We found that the duration of these calls almost doesn’t matter. The calls in this dataset had a wide variety of lengths – from as little as 15 minutes all the way past two hours. Funny enough, there is zero (statistically significant) change in conversion rates (or any other success metric) from call length to call length.

However, we did discover that a prospect is 12% more likely to show up to a discovery call when you send a calendar invite for 30 minutes rather than 60 minutes. So, even though how long the call ends up lasting doesn’t have any real impact on the final outcome of the sale (that we could find), it may be worth considering shooting for 30 minute calls to ensure your potential customer shows up to the meeting.

What else did you learn? What other patterns did you surface?

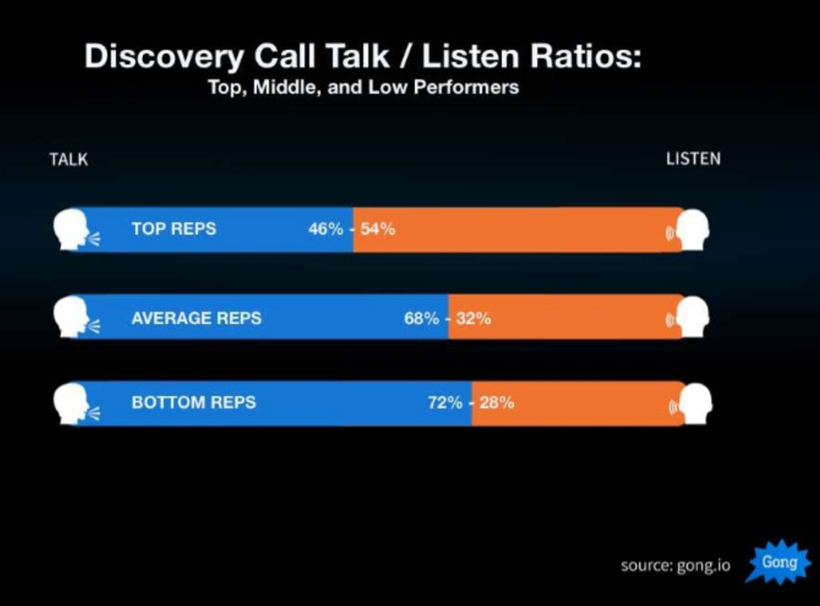

The patterns between talking and listening seem to be a pretty big deal when it comes to conversion rates (we call this “the talk-to-listen ratio”). Top, mid, and low performing salespeople all tend to have differing talk-to-listen ratios:

I want to make a quick point about this talk-to-listen ratio data: anyone who’s spent more than a year in sales probably “gets” this. We all understand a key part of sales effectiveness is listening more and “pitching” less. But what we don’t always understand is just how much talking we actually do. If you’re not measuring your own talk-to-listen ratio in some way, you’re probably doing much more talking than you think. When I first started at Gong, before I ever measured my own talk-to-listen ratio, I estimated that I’d end up somewhere around 50:50. After a week of doing sales calls, my average turned out to be 72:28. Needless to say, I was a bit embarrassed. I’d encourage all salespeople to do something similar: you may just learn something that helps you make President’s Club this year.

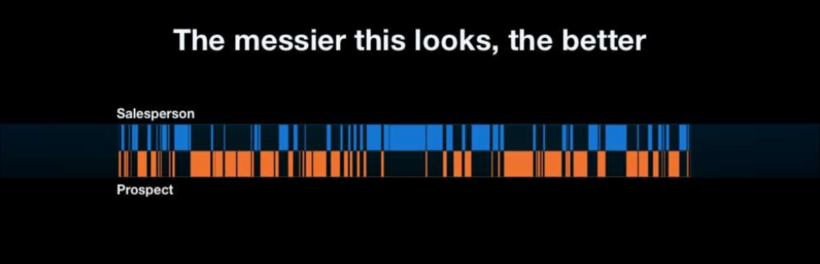

Now, related to the talk-to-listen ratio is how often you and your buyer “take turns” speaking and listening. We call that “speaker switches” here at Gong. And the more speaker switches that happen, the higher your conversion rates.

Your sales conversations should feel more like a ping pong match than a football game (where the longer you hold possession, the more likely you are to win). They should feel more like a casual chat over coffee than an interrogation.

I see so many salespeople making this mistake. We all understand not to pitch too much. But we haven’t all learned that interrogating your buyer with question after question without making it conversational is just as big of a blunder.

What can we take away from all of this for more effective selling?

A few things…

1. Ask more “targeted” questions: While you should strive to ask more questions, it’s important that they be targeted questions. By targeted, I mean they should be carefully crafted and aimed at a very specific customer problem (“What keeps you up at night?” is not a specific problem). This is easier said than done. Asking the right questions has less to do with charm and charisma and more to do with deeply understanding the nuances of your buyers’ business and problems. When you understand the set of problems your buyer has more deeply than they understand them themselves, you’ll know what questions to ask

2. Use “labeling” to get your buyer talking more without peppering them with interrogative questions: Chris Voss wrote one of the best “sales” books I’ve ever read: Never Split the Difference (it’s not actually a sales book; it’s a book about FBI-style negotiating). In the first chapter, he talks about a technique called labeling. Basically, you finish this sentence: “It seems like you _____________________.” The blank needs to be an emotion you observed your buyer express in one of their responses (and you need to be accurate for this to work, which requires intensive listening). An example of this may be: “It seems like you feel your company isn’t doing enough to solve this problem.” Then shut up. Your buyer, if you accurately labeled their emotion, will open up like a floodgate. The best part? You didn’t have to burn equity by asking another question.

3. Manage your time on sales calls: Most underperformers do not reserve enough time at the end of the call to effectively secure next steps without it feeling rushed. Try to wrap up the “meat and potatoes” of the discovery call with at least 7 minutes to spare. This will give you plenty of time to hash out any logistical issues you run into in your attempt to get the next meeting

4. Plan your questions: While it’s easy to suggest you ask more targeted questions, like I said above, this is easier said than done. If you aren’t yet at the “expert level” when it comes to your buyers’ business and problems, these targeted questions need to be planned out in advance. Start with planning three questions before each sales call (if you go more than that, you’ll likely forget them)

What about calls that aren’t discovery calls? Have you analyzed other “types” of sales calls?

Yes! We try to release new research and data every other week on our blog. Here are a few of the previous insights we’ve learned from conducting analysis like this: – Pricing: Top salespeople “talk price” between the 40-49 minute mark of their conference calls. Average sellers indiscriminately talk about price at random throughout any point in the call

– Filler words: As much as we sales pros hate filler words, they have absolutely no impact on conversion rates or any other success metric

– Risk-reversal language: Top salespeople use very specific language patterns to mitigate the perception of risk their buyers may have. We’ve seen close rates jump an average of 32% when this sort of language is used consistently. Some examples of risk-reversal language include talking about opt-out clauses, “cancel at any time,” money-back guarantees if applicable, SLAs, and any other deal term that is designed to reduce the customer’s risk in making a purchase.

Key Takeaways

Chris left me with some interesting food for thought. Sales conversations can be one of the most pivotal, leveraged points in the sales process, and they can become far more effective with the advances in AI. Marketers are able to improve online conversions with the help of analytics and now sales has the opportunity to do the same. Using analytics and intelligence to improve performance should be a welcome proposition for sales people who find themselves approaching sales conversations as purely a numbers game. While there will always be an element of art and intuition to the sales conversation, the conversation intelligence category, will change them from pure art, to something that’s equally art and science.